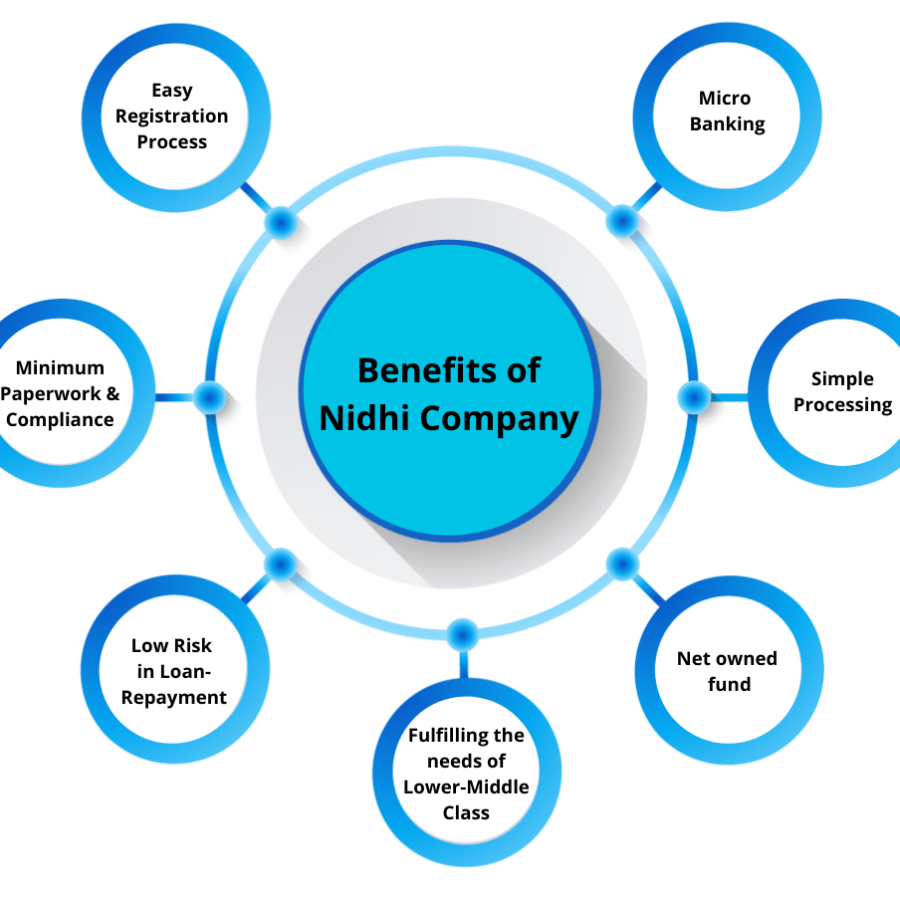

Nidhi Companies belong to the Non-banking financial companies structure. Registering a Nidhi Company allows a Nidhi to borrow from its members and lend to the members.Nidhi Companies are registered in India are created to cultivate the habit of thrift and savings among its members. The funds that are contributed to a Nidhi Company are only from its members.

For Incorporating a Nidhi Company, no license is required from the Reserve Bank of India. Hence, the formation of the Nidhi Company is easy. Nidhi Companies are registered as Public Companies and should have Nidhi Limited at the last of the name.It should also be noted that the Nidhi Companies fall under the purview of the Reserve Bank of India as the functioning of Nidhi Companies is similar to NBFCs.