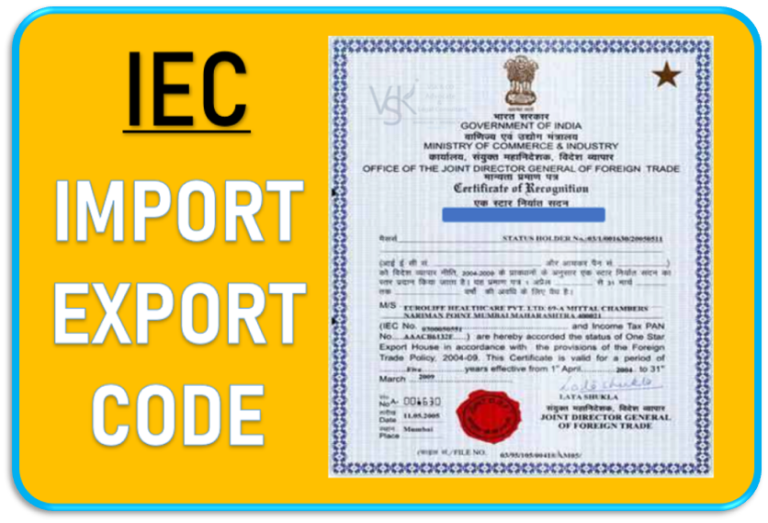

Import Export (IE) Code India is a registration of an import and export companies with Indian Custom department that import and export commodities from India. IE Code is issued by the Directorate General of Foreign Trade (DGFT), Ministry of Commerce and Industries, Government of India. IE Code application must be made to the Directorate General of Foreign Trade along with the necessary supporting documents.

Once, the application is submitted, DGFT will issue the IE Code for the entity in 15 – 20 working days or less.E Code registration is permanent registration which is valid for a lifetime. Hence, there will be no hassles for updating, filing and renewal of IE Code registration. It is valid until the business exists or the registration is revoked or surrendered. Further, unlike tax registrations like GST registration or PF registration, the importer or exporter does not require to file any filings or follow any other compliance requirement like annual filing.